Olesea Lisnic is a visionary leader transforming the insurance industry with her innovative platform, Insurancemig. She saw the need to simplify insurance processes and make them more accessible to modern consumers.

By leveraging insurtech innovations, she created a digital insurance platform that prioritizes customer needs and delivers efficiency. Insurancemig is designed to bridge traditional insurance with today’s technology-driven demands.

With features like AI in insurance and automated claims processing, it offers a seamless user experience. This platform not only simplifies insurance but also ensures transparency and security for every user.

Olesea Lisnic’s Vision: Transforming the Insurance Landscape

Olesea Lisnic is a visionary leader who is reshaping the insurance industry through insurance. She recognised the need to simplify insurance by removing complicated paperwork and processes.

Her goal was to create a customer-centric insurance platform that prioritizes user experience. Olesea has combined technology and finance expertise to redesign traditional systems.

She focuses on empowering consumers, promoting transparency, and delivering personalized insurance policies. Under her leadership, Insurancemig stands as a leading example of insurance technology trends.

The Birth of Insurancemig: Designed for the Digital Age

Insurance was born to address the outdated practices in the insurance industry. The platform integrates AI in insurance to automate and streamline processes.

With a fully digital infrastructure, Insurancemig allows users to compare policies, adjust coverage, and manage claims easily.

By combining end-to-end automation and a seamless user experience, Insurancemig eliminates traditional inefficiencies.

It uses machine learning in underwriting and risk assessment technology to make smarter decisions. Through real-time policy updates and data-driven insurance solutions, Insurancemig redefines how insurance is delivered.

Insurancemig’s Standout Features

Insurancemig offers AI-powered recommendations, ensuring users get policies tailored to their unique needs. Its unified dashboard provides a single platform to manage claims, renewals, and communication.

The platform’s end-to-end automation reduces manual tasks, saving users time and effort. Tailored solutions allow policies to evolve as user needs change. Insurancemig’s automated claims processing ensures quick and accurate resolutions.

The platform is built on secure insurance platforms, utilizing blockchain in insurance for enhanced transparency. Users benefit from fraud prevention systems and a streamlined process that reduces stress.

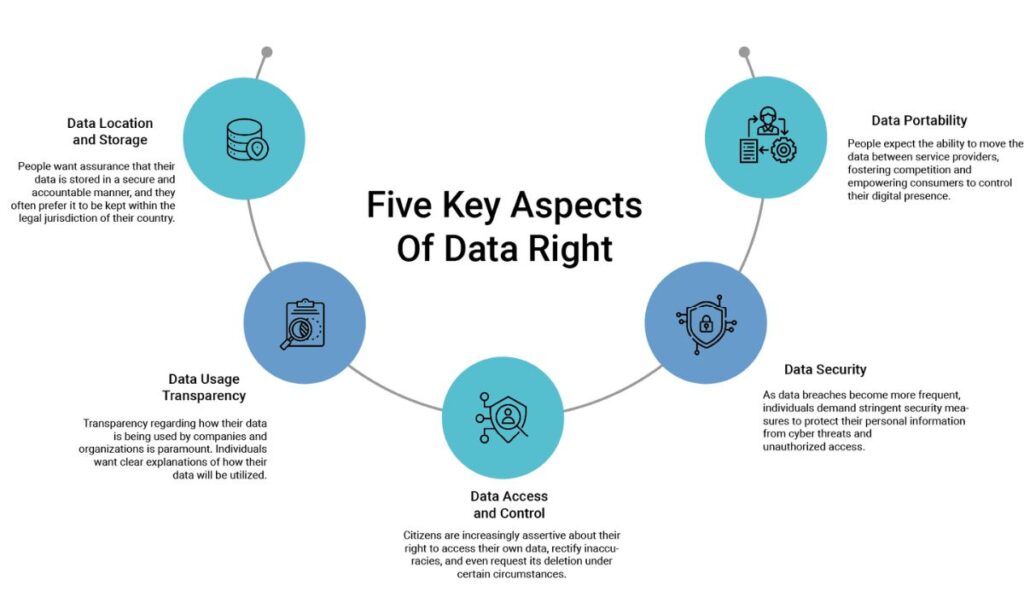

Security and Privacy at the Core of It All

Security is central to Insurancemig’s operations. It employs advanced encryption to protect user data and uses compliance standards to meet global regulations. The platform ensures secure transactions through reliable payment gateways.

Regular updates and audits maintain high standards, ensuring data-driven insurance solutions are trustworthy.

By prioritizing privacy, Insurancemig builds confidence and trust with its users. Fraud prevention systems further enhance the security of all processes.

Empowering Consumers with Transparency and Control

Insurancemig empowers users by simplifying complex terms and offering instant comparisons. Customers can easily understand policies and make informed choices. The customer-centric insurance approach puts control back into the hands of users.

Through custom coverage options, policies can be adjusted to fit evolving needs. Insurancemig emphasizes clarity, ensuring there are no hidden fees or fine print.

The Future of Insurancemig

Olesea Lisnic has ambitious plans for the future of Insurancemig. The platform will expand its offerings to include a wider range of insurance products.

With the integration of emerging technologies like blockchain, Insurancemig aims to enhance transparency in insurance further.

Global expansion is also on the horizon, as Insurancemig strives to enter the global insurance market. By continuing to innovate, the platform is set to lead the next wave of insurance industry disruption.

Making Insurance Effortless and Empowering

Insurancemig transforms insurance into a simplified insurance experience. With Olesea Lisnic’s leadership, the platform focuses on customer empowerment and delivering exceptional value.

The use of advanced technology ensures a seamless user experience, making insurance processes intuitive and stress-free.

Insurancemig is a prime example of insurance modernization, bridging traditional systems with digital solutions.

Frequently Asked Questions

How does Insurancemig use AI in insurance?

Insurancemig uses AI to provide personalized policy recommendations, automate claims processing, and improve risk assessment accuracy.

Is my data secure on the platform?

Yes, Insurancemig prioritizes security with advanced encryption, fraud prevention systems, and global compliance standards.

Can businesses use Insurancemig?

Absolutely. Insurancemig offers tailored solutions for businesses, covering assets, employees, and operations.

What types of insurance does Insurancemig provide?

Insurancemig offers a wide range of products, including life, health, property, and casualty insurance.

Will Insurancemig expand globally?

Yes, global expansion is a key part of Olesea Lisnic’s vision, ensuring more people benefit from the platform’s innovations.

Conclusion

Olesea Lisnic’s Insurancemig is a game-changer in the insurance industry. With its digital insurance platform, the company has made insurance more accessible, transparent, and efficient.By combining insurtech innovations with a customer-centric insurance approach, Insurancemig addresses longstanding challenges in the industry.

Its focus on security, automation, and transparency ensures users can trust the platform for all their insurance needs.As Insurancemig grows, it sets new standards for insurance digital transformation.